- FinChat

- Posts

- 🗞 6 Companies Ramping Up Buybacks At Record-Low Valuations

🗞 6 Companies Ramping Up Buybacks At Record-Low Valuations

These 6 stocks are pouring cash into buybacks at depressed multiples. Plus, an inside look at Snap and the social media landscape.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

📈 6 Companies ramping up buybacks near all-time low valuations:

🔐 Snap Holds the Key To Its Own Future

Let’s dive in!

Featured Story #1

6 Companies ramping up buybacks near all-time low valuations:

Like dividends, stock repurchases are a way for a company to return excess capital to shareholders. When a company begins quickly increasing its share repurchases, that’s typically an indication that a management team believes its shares to be undervalued.

If management’s assumptions are true, then the lower the valuation of those buybacks the more value accretive they are to shareholders.

Here are 6 companies ramping up stock buybacks near all-time low valuations:

With investor sentiment on Chinese companies souring lately, shareholders of the e-commerce giant Alibaba have had to endure some tough returns. In just a few years, Alibaba’s valuation has been cut by more than 80%.

Now the company is attempting to capitalize on that poor sentiment by investing all of its free cash flow (and then some) into share repurchases.

Buyback Yield: 11.5%

EV/EBIT: 10.4x

Over the last couple years, online dating conglomerate Match Group has experienced user declines across its largest app Tinder. This has led to a sharp revision in expectations from investors, and ultimately some significant multiple compression.

With the company now valued near a record low EV/EBIT, Match Group is pouring virtually all its cash flow into buybacks each quarter.

Buyback Yield: 9%

EV/EBIT: 13x

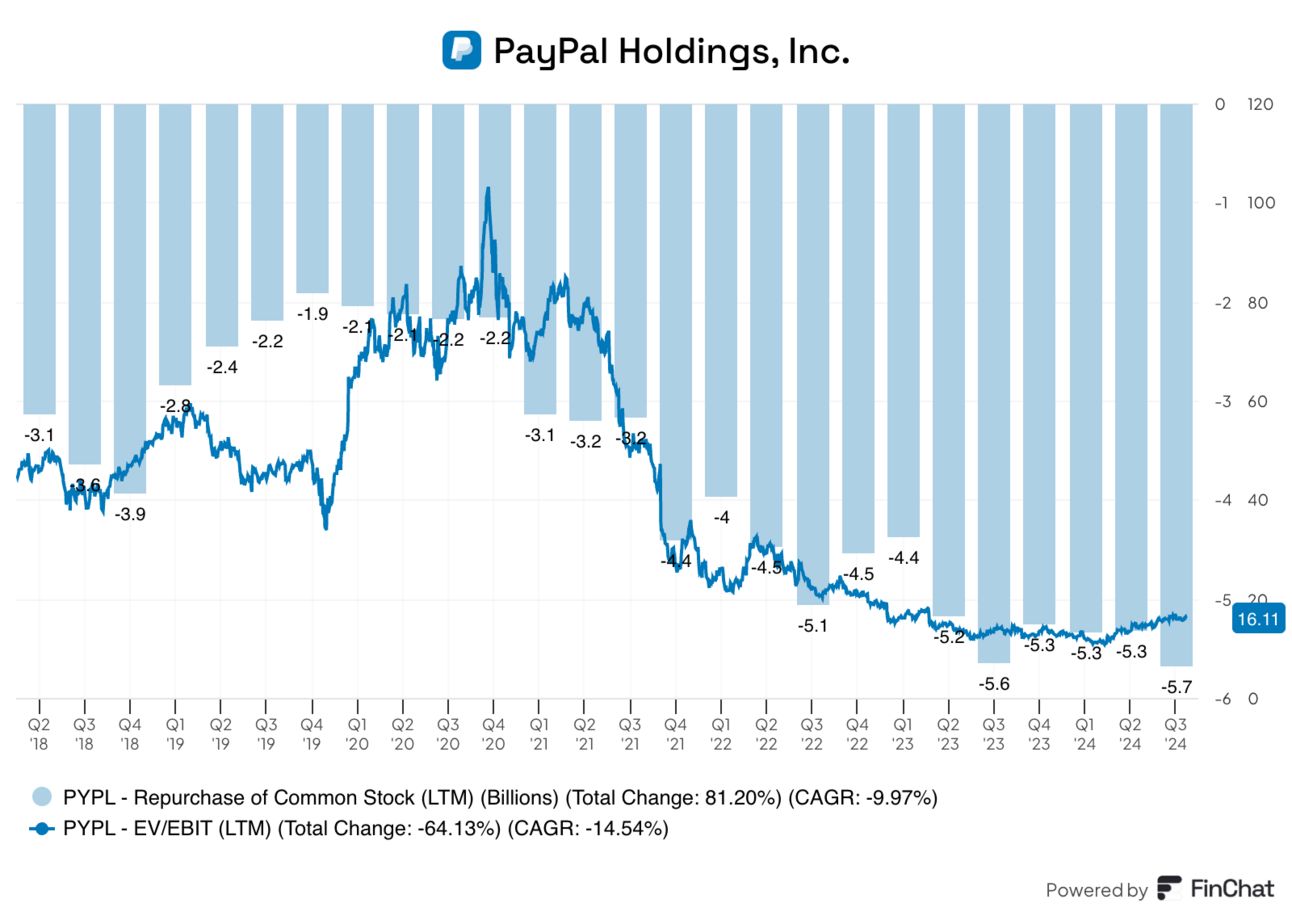

Payments giant PayPal has had a difficult last 5 years, as competition from Apple Pay and Google Pay has called into question the company’s core branded-checkout business.

Despite recovering more than 50% over the last 12 months, management is still deploying a record amount of capital to stock buybacks.

Buyback Yield: 6.3%

EV/EBIT: 16.1x

Altria, the leading manufacturer of cigarettes in the US, has traded at a seemingly low valuation for quite some time. However, with the recent increase in cigarette consumption declines, investors are even more sour on the business.

This near record-low multiple has encouraged Altria’s management to start buying back more stock than it traditionally does. Between its dividend and buyback, Altria is set to return roughly 12% of its market cap back to shareholders this year.

Buyback Yield: 3.9%

EV/EBIT: 8.9x

Adobe has seen its stock drop by 30% over the last 12 months as investors worry that the creative software giant could be at the risk of disruption from generative AI.

While the concerns are mostly speculative at this point, Adobe’s management is still doing its best to capitalize on the recent price action. Adobe has increased its share repurchases by more than 50% compared to a year ago.

Buyback Yield: 3.7%

EV/EBIT: 23.8x

With concerns of competition in the online payroll space heating up as of late, Paycom has seen its stock drop more than 60% from recent highs.

Despite continued top line growth, Paycom’s EV/EBIT is still near its lowest point in a decade. This depressed multiple has encouraged Paycom’s management team to quickly ramp up their repurchases in addition to the company’s small dividend.

Buyback Yield: 3.1%

EV/EBIT: 18.7x

Partner Spotlight: Uncover Alpha by Riharc Jarc

Snap Holds the Key To Its Own Future

Snap is a social media company operating the Snapchat app. Its users are mostly young adults and teens, and it is a competitor to TikTok as well as Meta. The company was founded in 2011. Snapchat has 443M daily active users. They generate $5.17B in revenue (LTM). The company makes revenue mostly from ads, but increasingly also from B2C subscription Snapchat+. They also have their own AR business segment.

If you have read my work before, especially my articles on Meta, Pinterest, and others, you know that one of the key figures I focus on when analyzing a social media company is the user base. In a company like Snap, the user base is the key indicator of the soundness of the company's base fundamentals.

A social media company's health is measured by its active user metric. If the users are there, the advertisers will follow.

Despite all the hurdles that the stock price has had over the years, the trend in terms of the user base remains clear. Snap continues to grow in terms of Daily Active Users every quarter (DAUs).

Today, Snap DAUs' growth mostly comes from ex-Europe and U.S. regions. Based on the total DAUs at 443M, Snapchat is also one of the most used apps in the world.

What is more impressive to me is that from the end of 2019 to today, Snap managed to grow DAUs despite this period being the period of the emergence and insane growth of TikTok.

Snap’s Challenges and Wall Street’s Current Focus

The problem for Snap is not its user base; the issues, in essence, derive from two places:

Snapchat is bad at ads (monetization)

Snapchat is acting like it is a bigger company than it is

Let's first look at their ad problems. The problem derives from a few places. Firstly, the demographic of younger adults and teenagers is very specific. The problem is that teenagers don't have the purchasing power that advertisers are looking for; because of this, campaigns on Snap from advertisers are often more focused on brand than performance.

Brand advertising is more susceptible to macro conditions, and when there is macro uncertainty, advertisers tend to cut those budgets and focus on performance until they become more comfortable with the macro. This is the period we had in the last 2 years.

The second problem that I see for Snap is their ego. More specifically, the company/management is acting like they are a much bigger company with much bigger resources than they actually are.

The problem for Snap is that most of this $1.7B goes into areas where it doesn't improve the core business. A big problem is investing $1.7B in “innovation” in AR, filters, and Smart glasses, but you missed the boat on AI targeting, which is your core product. Yes, Meta and Zuckerberg also invested in the Metaverse, AR and AI. Still, their core products are on fire and executing on all cylinders because Meta also invested first in Advantage+ and all these other tools.

And the problem of thinking you are bigger than you are is not limited only to R&D costs. The whole company's cost structure needs a revamp. They are spending $1.1B on stock-based compensation, over 21% of your revenue. Again, for comparison, Meta's SBC/revenue is around 10%, and they pay their employees very handsomely.

The revenue per employee figure also shows us that while Snap has started to improve in this realm, it is still vastly over-bloated compared to bigger competitors like Meta and Google:

So why now?

There are solutions to Snap's problems on almost every level:

Embrace the fact that your niche focus is young adults.

Snapchat+. B2C social media revenue streams are in their early innings.

AI & GenAI ad enhancements.

GenAI agents and chat platforms are a marriage made in heaven.

TikTok ban call option.

Pressure from stakeholders on the company because of the current valuation.

Smart glasses and AR facing an actual mainstream moment in 2025.

Summary

I understand Wall streets focus on Snap's ad monetization challenges, which is a fair point. However, the real value of a company like Snap is measured in user activity and engagement, which remain healthy. Monetization is a challenge that a company can overcome internally over time. I see a lot of tailwinds for Snap in the short to mid-term, as I mentioned in this article.

Most of their problems are controllable and can be resolved internally. A low market cap and unhappy stakeholders are starting to put more pressure on management, which even a fully controlled entity by its founders can't ignore if they want to run a prosperous business in the future.

Meme of the week

Earnings Season is back! 🎉

This is your friendly reminder to focus on the metrics that really matter. And there’s no easier place to do that than FinChat.io.

Our wicked fast data team will have the Segments & KPI data points updated immediately after earnings so you don’t have to wait!